Myths about the Mortgage Meltdown

Myth 1: Clinton caused the mortgage meltdown

Myth 2: Low income lending caused the mortgage meltdown

Myth 3: Bush did not contribute to the mortgage melt down

Myth 4: The private (free market) was not the cause of the mortgage meltdown

The increase of MBS (mortgage backed securities) purchased by the GSEs (Fannie and Freddie) from 2003 through 2006 under pressure from the Bush administration to meet their 56% affordable housing requirement started PRIVATE, market speculation – a 30 trillion dollar bubble worldwide on the PRIVATE, credit default swap derivatives markets – this was the cause of the housing bubble that burst into the subsequent economic crisis. Deregulation of the financial market allowed this bubble to occur. The private (free market) speculative derivative bubble caused the meltdown not the low income housing increase and subsequent loses. The low income housing loses in the Bush years resulted in tens of billions of dollars. The private market speculation for derivatives, 30 trillion dollars, is orders of magnitudes larger than the low income housing loses during the Bush years and is the only amount large enough to bring down the markets worldwide.

To understand how all this created the perfect storm see:

https://www.mixermuse.com/blog/2012/01/11/the-great-recession-how-the-free-market-got-rigged/

Even Alan Greenspan, a Republican, admitted in his interview with Brian Naylor:

BRIAN NAYLOR: The man once known as the maestro for his direction of the nation’s economy as Fed chairman sat for four long hours yesterday, watching lawmakers who once cheered his performances turn into harsh critics. Testifying before the House Oversight Committee, Greenspan didn’t down play the severity of the crisis in the nation’s markets.

Mr. ALAN GREENSPAN (Former Chairman, Federal Reserve): We are in the midst of a once-in-a-century credit tsunami. Central banks and governments are being required to take unprecedented measures.

NAYLOR: Under questioning from Democrats on the panel, Greenspan conceded he might have been, as he put it, partially wrong in not moving to regulate trading of some derivatives that are among the root causes of the credit crisis. He also admitted his free market ideology may be flawed. This exchange with committee chairman, Democrat Henry Waxman of California, verged on the metaphysical.

Representative HENRY WAXMAN (Committee Chairman, Democrat, 30th District of California): You found a flaw in the reality…

Mr. GREENSPAN: Flaw in the model that I perceived is a critical functioning structure that defines how the world works, so to speak.

Rep. WAXMAN: In other words, you found that your view of the world, your ideology was not right. It was not working.

Mr. GREENSPAN: How it – precisely. That’s precisely the reason I was shocked, because I’ve been going for 40 years or more with very considerable evidence that it was working exceptionally well.

http://www.npr.org/templates/story/story.php?storyId=96070766

In September 2002, Greenspan, Treasury Secretary Paul O’Neill, Securities and Exchange Commission chairman Harvey Pitt, and Commodity Futures Trading Commission chairman James Newsome wrote a letter to members of Congress to note their opposition to legislation that would regulate derivatives.

They wrote:

“We believe that the [over-the-counter] derivatives markets in question have been a major contributor to our economy’s ability to respond to the stresses and challenges of the last two years. This proposal would limit this contribution, thereby increasing the vulnerability of our economy to potential future stresses….

We do not believe a public policy case exists to justify this governmental intervention. The OTC (over the counter) markets trade a wide variety of instruments. Many of these are idiosyncratic in nature….

While the derivatives markets may seem far removed from the interests and concerns of consumers, the efficiency gains that these markets have fostered are enormously important to consumers and to our economy.

Greenspan and the others urged Congress “to be aware of the potential unintended consequences” of legislation to regulate derivatives.

They got it exactly wrong. Swaps and derivatives ended up undermining, not bolstering, the economy.

http://www.motherjones.com/politics/2008/10/alan-shrugged

Proof:

Certainly, a significant event that started the collapse happened during the last few years of the Clinton administration. The Gramm–Leach–Bliley Act of 1999, known as financial services deregulation,

“It repealed part of the Glass-Steagall Act of 1933, opening up the market among banking companies, securities companies and insurance companies. The Glass-Steagall Act prohibited any one institution from acting as any combination of an investment bank, a commercial bank, and an insurance company.”

http://en.wikipedia.org/wiki/Gramm-Leach-Bliley_Act

The bill was a compromise between the Clinton Administration and the House Republicans:

“The bill then moved to a joint conference committee to work out the differences between the Senate and House versions. Democrats agreed to support the bill after Republicans agreed to strengthen provisions of the anti-redlining Community Reinvestment Act and address certain privacy concerns; the conference committee then finished its work by the beginning of November. On November 4, the final bill resolving the differences was passed by the Senate 90-8, and by the House 362-57. This legislation was signed into law by Democratic President William Jefferson “Bill” Clinton on November 12, 1999.”

http://en.wikipedia.org/wiki/Gramm-Leach-Bliley_Act

“In 2003, the two [GSEs, Fannie and Freddie] bought $81 billion in subprime securities. In 2004, they purchased $175 billion — 44 percent of the market. In 2005, they bought $169 billion, or 33 percent. In 2006, they cut back to $90 billion, or 20 percent. Generally, Freddie purchased more than Fannie and relied more heavily on the securities to meet goals.

In 1997 the GSEs owned about 12% of the total market share of these securities. In 2001 the GSEs owned about 15% of the total market share of these securities. In 2008 this percentage had grown dramatically to 40%.

In intervening years it was much more. President Bush directed his HUD director to pressure the GSEs into buying massive amounts these MBS [Mortgage Backed Securities] on the open market. This created huge market for these securities and encouraged more and more risky private sector mortgages so they could be bought, bundled and sold on the open market largely to Fannie and Freddie.

But by 2004, when HUD next revised the goals, Freddie and Fannie’s purchases of subprime-backed securities had risen tenfold. Foreclosure rates also were rising.

That year, President Bush’s HUD ratcheted up the main affordable-housing goal over the next four years, from 50 percent to 56 percent. John C. Weicher, then an assistant HUD secretary, said the institutions lagged behind even the private market and “must do more.”

For Wall Street, high profits could be made from securities backed by subprime loans. Fannie and Freddie targeted the least-risky loans. Still, their purchases provided more cash for a larger subprime market.

“That was a huge, huge mistake,” said Patricia McCoy, who teaches securities law at the University of Connecticut. “That just pumped more capital into a very unregulated market that has turned out to be a disaster.””

“In 2003, the two bought $81 billion in subprime securities. In 2004, they purchased $175 billion — 44 percent of the market. In 2005, they bought $169 billion, or 33 percent. In 2006, they cut back to $90 billion, or 20 percent. Generally, Freddie purchased more than Fannie and relied more heavily on the securities to meet goals.

“The market knew we needed those loans,” said Sharon McHale, a spokeswoman for Freddie Mac. The higher goals “forced us to go into that market to serve the targeted populations that HUD wanted us to serve,” she said.”

But because Fannie and Freddie were buying mortgage-backed securities rather than the actual subprime loans, their involvement came too late to require stiffer standards from lenders.

Fannie and Freddie “made no progress in civilizing the market,” said Sandra Fostek, a senior regulator at HUD.

William C. Apgar Jr., who was an assistant HUD secretary under Clinton, said he regrets allowing the companies to count subprime securities as affordable.

“It was a mistake,” he said. “In hindsight, I would have done it differently.””

http://www.washingtonpost.com/wp-dyn/content/article/2008/06/09/AR2008060902626.html

Conclusion: Even though Fannie, Freddie and FHA had much less to do with new loans in the Bush administration they bought huge amounts of MBS in those years to meet President Bush’s 56% housing requirement.

Additionally, the President encouraged the GSEs to “focus” their “core housing mission” “with respect to low-income Americans and first-time homebuyers” in the following statement from the White House,

“The Administration strongly believes that the housing GSEs should be focused on their core housing mission, particularly with respect to low-income Americans and first-time homebuyers. Instead, provisions of H.R. 1461 that expand mortgage purchasing authority would lessen the housing GSEs’ commitment to low-income homebuyers.”

http://georgewbush-whitehouse.archives.gov/omb/legislative/sap/109-1/hr1461sap-h.pdf

Conclusion: President Bush had directed HUD to require the GSEs to meet the 56% low income housing requirement. This pressured the GSEs to buy massive MBS. This created a massive market for junk mortgages.

Credit Default Swaps are insurance policies on mortgages, sort of like the futures market for commodities for MBS. Credit Default Swaps are not regulated. The government did not own credit default swaps. This was purely a private market commodity.

Between 2000 and 2008, the market for such swaps ballooned from $900 billion to more than $30 trillion.

http://topics.nytimes.com/top/reference/timestopics/subjects/c/credit_default_swaps/index.html?inline=nyt-classifier

This is what brought AIG down.

Goldman Sachs played both sides MBS and Credit Default Swaps.

When the Fannie and Freddie bought huge amounts of MBS, pressured by the Bush administration, the market for credit default swaps went astronomical. This is ultimately what broke them and resulted in tax payers having to bail them out.

http://money.cnn.com/magazines/fortune/fortune_archive/2005/01/24/8234040/index.htm

If you do not believe me what about Greenspan, Treasury Secretary Paul O’Neill, Securities and Exchange Commission chairman Harvey Pitt, and Commodity Futures Trading Commission chairman James Newsome (quoted above)?

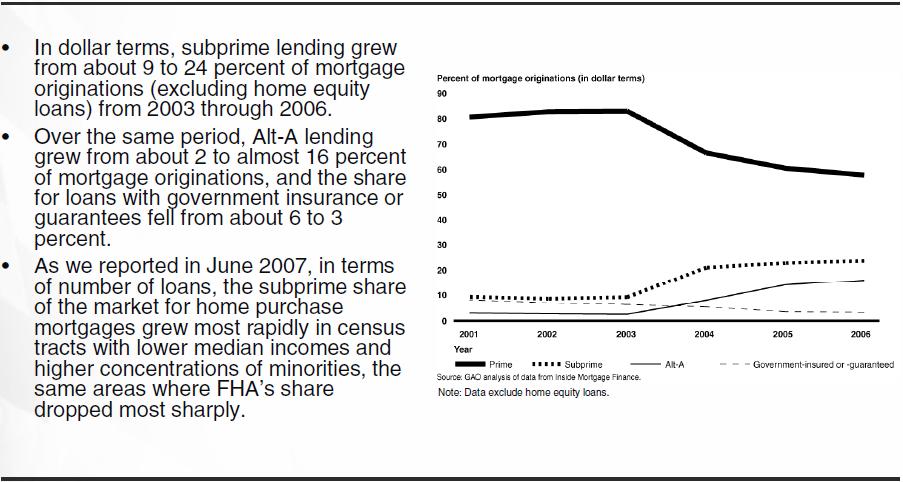

Here are the numbers that show:

1) the percent of subprime lending to total mortgage originations

2) the percent of Alt-A lending to total mortgage originations – An Alt-A mortgage, short for Alternative A-paper, is a type of U.S. mortgage that, for various reasons, is considered riskier than A-paper, or “prime”, and less risky than “subprime,” the riskiest category. Alt-A interest rates, which are determined by credit risk, therefore tend to be between those of prime and subprime home loans. Typically Alt-A mortgages are characterized by borrowers with less than full documentation, lower credit scores, higher loan-to-values, and more investment properties. A-minus is related to Alt-A, with some lenders categorizing them the same, but A-minus is traditionally defined as mortgage borrowers with a FICO score of below 680 while Alt-A is traditionally defined as loans lacking full documentation. Alt-A mortgages may have excellent credit but may not meet underwriting criteria for other reasons – http://en.wikipedia.org/wiki/Alt-A

3) GSE backed loans

the percent of the total market of GSE and FHA, sub-prime loans (Col 1)

the default percentage of the total market (Col 2)

the amount in billions of the total market defaults (Col 3 )

Note: All currency amounts in billions

Year Col 1 Col 2 Col 3

1997 10% 0.9% $8

1999 13% 0.9% $12

2001 12% 0.7% $17

2003 11% 0.6% $21

2005 11% 1.5% $9

2007 13% 0.5% $28

Detail for Subprime Loans – see endnotes for sources (page 10 pdf)

http://www.aei.org/docLib/Pinto-High-LTV-Subprime-Alt-A.pdf

GSE Investment Portfolio and MBS ($ Billions, Left Axis)

GSE % of Total Outstanding Single Family Mortgages (Right Axis)

http://www.fcic.gov/hearings/pdfs/2010-0227-Jaffee.pdf

GAO report (page 18 for sub-prime data and page 21 for default rates data in pdf):

http://www.mortgagebankers.org/files/News/InternalResource/57640_GAOReportInformationonRecentDefaultandForeclosureTrends.pdf

http://www.aei.org/docLib/Pinto-High-LTV-Subprime-Alt-A.pdf (page 12 pdf)

This data clearly shows that:

The increase of low income, sub-prime loans and the low overall default rate of all loan originations (1.5% in 2005 was the highest tracked in this data, through 2007). This dispels that myth that the crisis was caused by loan defaults of low-income folks.

For more informations see – https://www.mixermuse.com/blog/2010/10/14/how-george-bush-and-the-private-mortgage-market-created-the-perfect-storm/