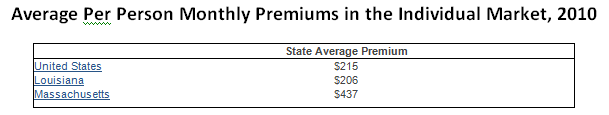

On Monday, July 2, Bill Cassidy(R), a congressional representative from Baton Rouge (LA), attacked President Obama’s Health Care Reform Act on MSNBC’s “MSNBC Live”. Thomas Roberts, the interviewer, tried to compare the Romney based health care system in Massachusetts with Louisiana’s health care system. Bill Cassidy referred to the Kaiser Family Foundation’s web site where statistics on health care are stored. Cassidy told Thomas that Massachusetts had the highest monthly premium rate in the country for health care. This is certainly true as this link from the Kaiser Family Foundation shows:

However Bill has only told part of the story. Louisiana has one of the worst health care systems in the country. “Louisiana Medical News” reports:

A coalition of healthcare providers is hoping to convince the Jindal administration to use federal stimulus funds to dollars to prevent crushing Medicaid healthcare cuts.

…

The situation, as laid out in DHH’s report “A Road Map for a Healthier Louisiana” is this:

The state spent $7.4 billion on healthcare in 2009 but squandered the opportunity to improve people’s health, the report says. The fragmented delivery system – almost exclusively fee-for-service – resulted in uneven quality of care, inequitable access to care and unpredictable costs.

The system was designed to provide episodic and acute care not to promote and maintain health, the report says. Louisiana has to move to a system of care that will improve health outcomes and move the state from its perpetual ranking at or near the bottom of the nation’s health rankings while dealing with multi-billion dollar budget shortfalls and government downsizing.

“The Institute of Medicine (of the National Academy of Sciences), says it best,” according to the report. “The current system cannot do the job. Trying harder will not work. Changing systems of care will.”

Considerable evidence shows that managed, coordinated care can improve health outcomes and lead to savings; in some cases, the savings can be 20 percent, the report shows.

In a prepared statement, Greenstein said Louisiana has been on the predictable path to poor health outcomes and high healthcare costs for too long.

“It’s a path that we follow, guided by systems that are inefficient at best, and broken, at worst,” Greenstein said. “Without change, it will only worsen.”

Governor Jindal’s FY2012 budget states:

The FY 12 budget also preserves provider rates by incorporating $49.5 million State General Fund to cover the carryover increases in utilization costs from FY 2011 that are now part of the base needs of the Medicaid budget.

The Associated Press reports:

As the state’s Medicaid rolls continue to climb, Louisiana’s health agency will have $280 million less in this new budget year to cover the cost of care for patients.

That fact spells trouble, according to Louisiana’s health chief, physician and hospital groups.

The Medicaid budget for fiscal 2011, which began last week, stands at $6.5 billion, down from $6.78 billion for the fiscal year that ended June 30.

The budget requires reduced payments to physicians, hospitals and other health care providers for the 1.28 million residents enrolled in Medicaid, the state and federal government’s partnership that provides health care for the poor and uninsured.

The Associated Press also reports:

Louisiana’s health department is working on how to cut $859 million from the state’s Medicaid program for the poor and uninsured, stripping 11 percent of the funding for health services.

…

On the chopping block are charity hospitals, hospice care and Medicaid providers.

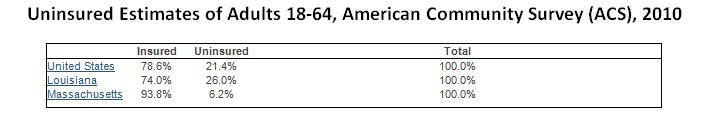

The Kaiser Family Foundation also shows these statistics on the uninsured in Louisiana:

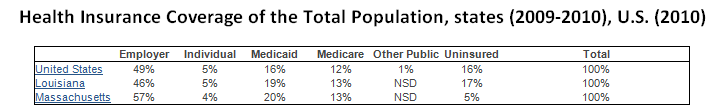

The table shows that for adults 18 to 64 years old 26% of the people in Louisiana have no insurance while 6.2% do not have insurance in Massachusetts. The other table shows that for all ages 17% of the people in Louisiana are uninsured as opposed to 5% in Massachusetts.

The monthly poverty level (FPG) for a family of 3 in Louisiana is $2,933. Here is Louisiana’s Medicaid qualification requirement as a percent of the poverty level:

Non-working — 13%

Working — 20%

Medically Needy

Individual — 13%

Couple — 20%

13% of $2,933 is $381.29/month or $4,575.48/year for a family of three.

20% of $2,933 is $586.60/month or $7,039.20/year for a family of three.

Some special cases such as children or pregnant women have better qualification requirements.

In Massachusetts here are the low income guidelines for monthly premiums:

• If your income is 100% FPG or less, you do not have to pay monthly premiums.

• If your income is 150% FPG or less, you do not have to pay monthly premiums if you choose the lowest cost plan offered in your area. If you choose a higher cost plan, you will have to pay a monthly premium.

• If your income is more than 150% FPG but not more than 300% FPG, you must pay monthly premiums that depend on income, where you live, and the plan you choose.

• Everyone must pay copayments for prescription drugs.

When Bill Cassidy makes an argument based on average monthly premiums in Massachusetts he conveniently ignores the fact that Massachusetts’ premiums are income adjusted. In Louisiana they prefer to keeps large portions of their population uninsured. This is an unsustainable path for Louisiana. That cannot afford the lousy system they have.

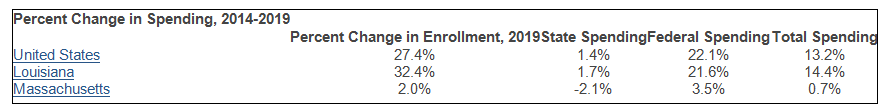

The table below shows the increase in total spending by percent if Louisiana and Massachusetts were to cover Medicaid to 133% of the poverty line as the Health Care Reform Act requires in order to receive expanded Medicaid funding from the Federal Government:

Medicaid Expansion to 133% of Federal Poverty Level (FPL): Estimated Increase in Enrollment and Spending Relative to Baseline by 2019

These charts clearly show that Louisiana is fighting very hard to have one of the worst health care systems in the country. The system in Louisiana is certainly on the brink of collapse as Bill Cassidy maintains. Bill Cassidy and Bobby Jindal would like to attack Romney-Care in Massachusetts which is a much better program than what Louisiana has to offer. Here is Bill Cassidy’s plan for health care in Louisiana:

•Providing greater flexibility for the use of Health Savings Accounts;

•Reforming the medical liability tort system to reduce frivolous lawsuits that drive up costs by forcing doctors to practice defensive medicine;

•Creating pooling mechanisms, like Individual Membership Associations and Association Health Plans, that provide patients greater flexibility and bargaining power;

•Providing tax credits to cover the cost of health care for low-income families;

•Allowing patients to shop for insurance across state lines;

•Providing patients who wish to opt out of federal programs (like Medicaid) vouchers to purchase private coverage;

•Allowing employers to offer discounts to incentivize participation in wellness programs; and

•Ensuring coverage for those with pre-existing conditions by strengthening high risk/reinsurance pools.

President Obama’s Health Care Reform Act already includes many of Cassidy’s ideas.(1) However, Cassidy’s plan does nothing for the uninsured and people that do not make enough money to worry about taxes. Cassidy’s Louisiana would continue to let substantial portions of people in Louisiana continue to use the emergency room for health care. This will only drive up premiums over the long term as it has in the rest of the country. Even though Louisiana has continued to cut provider reimbursement fees to attempt to make up their tremendous shortfalls, all they have really done is to demonstrate how Medicaid in Louisiana would be great if you could only find a health care professional in Louisiana that would be willing to do the work. When they make Louisiana’s problems, which they have created in Louisiana, an indictment of Massachusetts health care, they conveniently fail to acknowledge that you can find a health care professional in Massachusetts that is willing to do health care work. While criticizing Medicaid, Cassidy even seems to want Medicaid to prop up the poor health care system in Louisiana with Medicaid “vouchers”. Cassidy and Jindal can only remain silent when it comes to addressing the real problems in Louisiana because their ideology prevents them from acknowledging and effectively addressing the fundamental problems. Mitt understood this when he was governor of Massachusetts and with the Heritage Foundation crafted a program that began to acknowledge and address underlying health care problems.

Thomas Roberts should never allow politicians like Cassidy and Jindal to throw stones at Massachusetts’ health care when they live in glass houses.

—————————————————————————————————————————

(1) From the summary of the Affordable Care Act from the Kaiser Foundation:

“Providing greater flexibility for the use of Health Savings Accounts” (Bill Cassidy)

Benefit Tiers – Affordable Care Act (from link above):

“Create four benefit categories of plans plus a separate catastrophic plan to be offered through the Exchange, and in the individual and small group markets:

– Bronze plan represents minimum creditable coverage and provides the essential health benefits, cover 60% of the benefit costs of the plan, with an out-of-pocket limit equal to the Health Savings Account (HSA) current law limit ($5,950 for individuals and $11,900 for families in 2010);

– Silver plan provides the essential health benefits, covers 70% of the benefit costs of the plan, with the HSA out-of-pocket limits;

– Gold plan provides the essential health benefits, covers 80% of the benefit costs of the plan, with the HSA out-of-pocket limits;

– Platinum plan provides the essential health benefits, covers 90% of the benefit costs of the plan, with the HSA out-of-pocket limits;

– Catastrophic plan available to those up to age 30 or to those who are exempt from the mandate to purchase coverage and provides catastrophic coverage only with the coverage level set at the HAS current law levels except that prevention benefits and coverage for three primary care visits would be exempt from the deductible. This plan is only available in the individual market.

• Reduce the out-of-pocket limits for those with incomes up to 400% FPL to the following levels:

– 100-200% FPL: one-third of the HSA limits ($1,983/individual and $3,967/family);

– 200-300% FPL: one-half of the HSA limits ($2,975/individual and $5,950/family);

– 300-400% FPL: two-thirds of the HSA limits ($3,987/individual and $7,973/family).

These out-of-pocket reductions are applied within the actuarial limits of the plan and will not increase the actuarial value of the plan.”

“Reforming the medical liability tort system to reduce frivolous lawsuits that drive up costs by forcing doctors to practice defensive medicine” (Bill Cassidy)

Medical Malpractice – Affordable Care Act (from link above):

“Award five-year demonstration grants to states to develop, implement, and evaluate alternatives to current tort litigations. Preference will be given to states that have developed alternatives in consultation with relevant stakeholders and that have proposals that are likely to enhance patient safety by reducing medical errors and adverse events and are likely to improve access to liability insurance. (Funding appropriated for five years beginning in fiscal year 2011)”

“Creating pooling mechanisms, like Individual Membership Associations and Association Health Plans, that provide patients greater flexibility and bargaining power” (Bill Cassidy)

Creation and structure of health insurance exchanges – Affordable Care Act (from link above):

“Create state-based American Health Benefit Exchanges and Small Business Health Options Program (SHOP) Exchanges, administered by a governmental agency or non-profit organization, through which individuals and small businesses with up to 100 employees can purchase qualified coverage. Permit states to allow businesses with more than 100 employees to purchase coverage in the SHOP Exchange beginning in 2017. States may form regional Exchanges or allow more than one Exchange to operate in a state as long as each Exchange serves a distinct geographic area. (Funding available to states to establish Exchanges within one year of enactment and until January 1, 2015)”

“Providing tax credits to cover the cost of health care for low-income families” (Bill Cassidy)

Tax changes related to financing health reform – Affordable Care Act (from link above):

“• Increase the tax on distributions from a health savings account or an Archer MSA that are not used for qualified medical expenses to 20% (from 10% for HSAs and from 15% for Archer MSAs) of the disbursed amount. (Effective January 1, 2011)

• Limit the amount of contributions to a flexible spending account for medical expenses to $2,500 per year increased annually by the cost of living adjustment. (Effective January 1, 2013)

• Increase the threshold for the itemized deduction for unreimbursed medical expenses from 7.5% of adjusted gross income to 10% of adjusted gross income for regular tax purposes; waive the increase for individuals age 65 and older for tax years 2013 through 2016. (Effective January 1, 2013)”

Also, Small business tax credits related to financing health reform – Affordable Care Act (from link above):

“• Provide small employers with no more than 25 employees and average annual wages of less than $50,000 that purchase health insurance for employees with a tax credit.

– Phase I: For tax years 2010 through 2013, provide a tax credit of up to 35% of the employer’s contribution toward the employee’s health insurance premium if the employer contributes at least 50% of the total premium cost or 50% of a benchmark premium. The full credit will be available to employers with 10 or fewer employees and average annual wages of less than $25,000. The credit phases-out as firm size and average wage increases. Tax-exempt small businesses meeting these requirements are eligible for tax credits of up to 25% of the employer’s contribution toward the employee’s health insurance premium.

– Phase II: For tax years 2014 and later, for eligible small businesses that purchase coverage through the state Exchange, provide a tax credit of up to 50% of the employer’s contribution toward the employee’s health insurance premium if the employer contributes at least 50% of the total premium cost. The credit will be available for two years. The full credit will be available to employers with 10 or fewer employees and average annual wages of less than $25,000. The credit phases-out as firm size and average wage increases. Tax-exempt small businesses meeting these requirements are eligible for tax credits of up to 35% of the employer’s contribution toward the employee’s health insurance premium.”

“Allowing patients to shop for insurance across state lines” (Bill Cassidy)

Health care choice compacts and national plans – Affordable Care Act (from link above):

“Permit states to form health care choice compacts and allow insurers to sell policies in any state participating in the compact. Insurers selling policies through a compact would only be subject to the laws and regulations of the state where the policy is written or issued, except for rules pertaining to market conduct, unfair trade practices, network adequacy, and consumer protections. Compacts may only be approved if it is determined that the compact will provide coverage that is at least as comprehensive and affordable as coverage provided through the state Exchanges. (Regulations issued by July 1, 2013, compacts may not take effect before January 1, 2016)”

“Providing patients who wish to opt out of federal programs (like Medicaid) vouchers to purchase private coverage” (Bill Cassidy)

Medicaid – Affordable Care Act (from link above)…This could provide a basis for Bill Cassidy’s idea:

“Provide states with new options for offering home and community-based services through a Medicaid state plan rather than through a waiver for individuals with incomes up to 300% of the maximum SSI payment and who have a higher level of need and permit states to extend full Medicaid benefits to individual receiving home and community-based services under a state plan. (Effective October 1, 2010)”

“Allowing employers to offer discounts to incentivize participation in wellness programs” (Bill Cassidy)

Wellness programs – Affordable Care Act (from link above):

“• Provide grants for up to five years to small employers that establish wellness programs. (Funds appropriated for five years beginning in fiscal year 2011)

• Provide technical assistance and other resources to evaluate employer-based wellness programs. Conduct a national worksite health policies and programs survey to assess employer-based health policies and programs. (Conduct study within two years following enactment)

• Permit employers to offer employees rewards—in the form of premium discounts, waivers of costsharing requirements, or benefits that would otherwise not be provided—of up to 30% of the cost of coverage for participating in a wellness program and meeting certain health-related standards. Employers must offer an alternative standard for individuals for whom it is unreasonably difficult or inadvisable to meet the standard. The reward limit may be increased to 50% of the cost of coverage if deemed appropriate. (Effective January 1, 2014) Establish 10-state pilot programs by July 2014 to permit participating states to apply similar rewards for participating in wellness programs in the individual market and expand demonstrations in 2017 if effective. Require a report on the effectiveness and impact of wellness programs. (Report due three years following enactment)”

“Ensuring coverage for those with pre-existing conditions by strengthening high risk/reinsurance pools” (Bill Cassidy)

Temporary high risk pools – Affordable Care Act (from link above):

“• Establish a temporary national high-risk pool to provide health coverage to individuals with pre-existing medical conditions. U.S. citizens and legal immigrants who have a pre-existing medical condition and who have been uninsured for at least six months will be eligible to enroll in the high-risk pool and receive subsidized premiums. Premiums for the pool will be established for a standard population and may vary by no more than 4 to 1 due to age; maximum cost-sharing will be limited to the current law HSA limit ($5,950/individual and $11,900/family in 2010). Appropriate $5 billion to finance the program. (Effective within 90 days of enactment until January 1, 2014)”

This clearly shows that every point Bill Cassidy brings up is already addressed. It is almost as if part of the Act was written in response to Bill Cassidy’s recommendations. Yet, Bill Cassidy vehemently opposes the Affordable Care Act. The new Republicans could have done what the older Republicans did and fashion the bill even more in the direction they wanted. Instead, they made a political issue out of it and refused to work with the Democrats. Democracy cannot work with this kind of ideologically based inflexibility. Voters would do well to vote for politicians that produce results not rhetoric.