With regard to Jeff’s comments:

Jeff,

Thanks for your feedback. I am glad you liked it. Sorry I took a while to respond but my software work has been getting more time consuming lately. Here are my observations about your remarks.

First, without access to the details of these studies, we really don’t know what to do with this information. For example, it could be the case that 80% of those with an enlarged amygdala are conservatives, but only 0.01% of conservatives have an enlarged amygdala. If something like this is the case, then these studies really say nothing useful at all about conservatives.

Here are the studies the original article cited (there are more studies referenced in these studies as well):

http://blog.psico.edu.uy/cibpsi/files/2011/04/brains.pdf

http://lcap.psych.ucla.edu/pdfs/amodio_natureneuroscience07.pdf

The details about the study’s methodology are discussed in the beginnings of each article. The methodology looks sound to me as it is typical for these kinds of studies. Both of the institutions are top notch for neuroscience research.

Second, Mark goes on to depict conservatism, at least in part, as being about a fear of loss of control. But at least one counterexample exists, and a very large one: conservatives (or at least fiscal ones) advocate free markets, wherein control is utterly relinquished to the whims of trillions of individual and localized decisions; but liberals and progressives tend to dislike (fear?) the messiness and chaos of free markets, preferring something more planned, controlled, and centralized.

I suppose my take on this would be:

- Fear and problem solving are two very different discernable behaviors. If the response to a perceived problem is highly negative and emotionally charged then it looks like fear to me. If the response to a perceived problem tries to deal with the details of the problem and offer concrete, non-emotional solutions then I would think that would indicate a different part of the brain is operational. I am not sure dislike and fear are synonyms. I can dislike an ex-girlfriend but I do not fear her. I can disagree with Republicans on many things including the ‘free market’ but the ‘free market’ does not scare or threaten me.

- I think paranoia is a clearer, more intense example of fear than other types of generalized fear so I will try to use that as an example. I suppose anything can become the object of paranoia. I live in Boulder and seek out liberals as I did also in academia. I have never found liberals in those situations that I would describe as ‘fearing’ the ‘free market’. I have seen intense dislike of it though. For me, the fear thing is quite evident with paranoia – like ‘they are after me’ and ‘I need to get a gun to protect myself’ and ‘prying cold, dead fingers off my gun’ and ‘the blood of patriots’ and ‘the government is controlling us’ etc.. I have hardly ever heard liberals talk in these paranoid terms about the ‘free market’. I have, with effort, found some extremely leftist sites on the web that probably would fall into that category. However, I think that magnitudes and proportions matter in all these types of discussions. I do not know the statistical general population numbers for this kind of paranoia so I can only use my anecdotal knowledge and offer the impression that I think more conservatives fall into the paranoia category than liberals.

- If someone is trying to protect and defend something that he or she thinks they have and that someone is trying to take away, -that is a personal threat. Conservatives seem to think that they have something or once had it and that the liberals and government is trying to take it away from them (conservatives want to conserve, keep, hold on to). It seems to me that that reaction is typically one of fear. Just listen to Glenn Beck or Rush and think of the fear latent terms they are using. They actually have older people afraid to go out of their house for the big, bad, boogie, socialist, commy, radical Islamist, Obama control of the government which he is destroying (my dad included). While Beck and Rush are making money on this, older people are really getting scared by it all. I do not think liberals are ‘afraid’ of the ‘free market’. I think they want reasonable controls and regulation to make sure the market is more fair and not so tilted to the folks that are already huge beneficiaries of a tilted market. One thing certainly is different from the conservatives I described – liberals are not trying to protect something they think they had from the ‘free market’ that someone is trying to take away from them. Control may be fear based or reason based. I try to give some control for my kids but I do not fear my kids, I love them like crazy! I think you have to look at how the control is described (its terms, adjectives, adverbs, facial expressions, etc.) to figure out the emotive import.

-

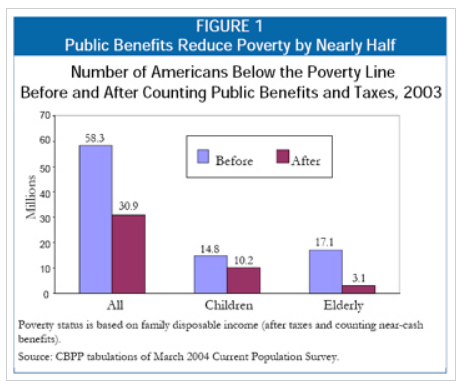

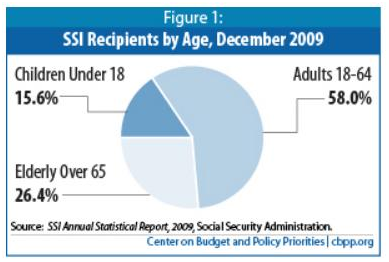

I think that one thing about this study is that it is time and culturally sensitive. For example, if we had a communist country and a ‘conservative’ party was perceived as trying to take housing, food, health care, etc. away from those that already comfortably had it, then I think a fear type, paranoid response could be feasible. As much as conservatives want to make the ‘nanny state’ argument in this country the census data* shows that 1 out of every 2 people are living at or near the poverty line (the poverty level for 2011 was set at $22,350 (total yearly income) for a family of four). ‘Nannies’ are generally for rich people – these income levels are not the lap of luxury. There is no way a family of four can be deemed ‘comfortable’ or getting ‘nannied’ by the government with this amount of income. I have never heard these folks defending their poverty situation in rhetorical terms like the conservatives use. In the latter case the issue is taking away something that is not working and in the former case the issue seems to be taking away something they think is worth protecting (dying for as the ‘blood of patriots’ demonstrates). I am not sure these studies should be taken as always applying to each and every case of what we think of as ‘conservative’ and ‘liberal’ for all time. I guess I look at it more like a snapshot of our particular present circumstances.

Third, and with tongue partly in cheek, could it be the case that those with a larger “part of the brain that processes conflicting information” (from Wikipedia’s definition of the anterior cingulate cortex) tend to be liberal because they are better equipped to deal with the resulting cognitive dissonance?

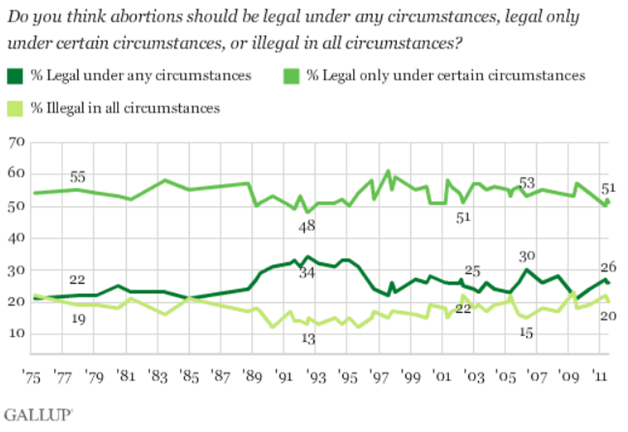

First, I like cognitive dissonance because it motivates me to think and do research. Perhaps one way to deal with cognitive dissonance is to pretend like it does not exist but there are more productive ways to deal with it (and actually like it with practice). With regard to your article, I think there is a bit of heavy handed stereotyping going on in it. I have never met a liberal or conservative that has claimed they are always right about everything. I would think of that as some sort of pathological problem. I think there are folks on both sides that get defensive, feel like they are pinned into a corner and lapse into a simplistic ‘well I am right and you are wrong’, lack of a defense, type argument. I also find the main premise of your article is that it obvious that Obama was wrong on everything (or most things) and the liberals ‘really’ know it and are just trying to cover it up – this is called a loaded question (or argument) because it makes unexamined conclusions at the outset. To make the claim that liberals really know Obama is awful is speculation on your part that needs further examination (not assuming it at the beginning and trying to dissect their intentions after the fact). This type of argumentative move reminds me of the anti-choice’ folks that automatically assume that pro-choice folks are ‘killing babies’, Nazis that believe in genocide, etc.. There is no middle ground for those types. They assume that you must believe that a fetus is a ‘baby’ and that any pro-choice discussion is really a defense of baby killing. This is a problem of extremism and radicalizing everyone else that does not believe in your truth. I call this type of argument the ‘pushing the middle ground to an extreme in order to refute it’ or straw man argument.

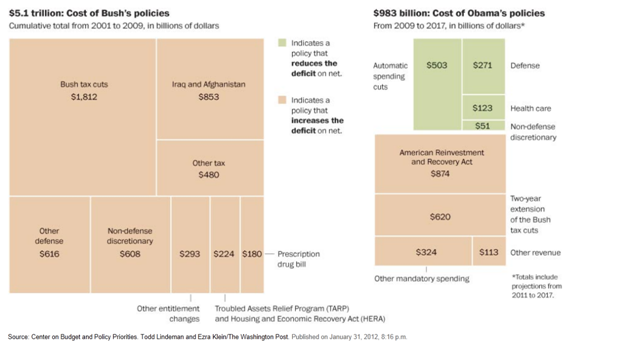

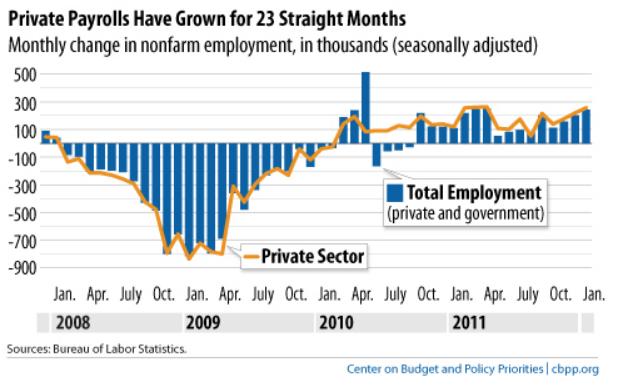

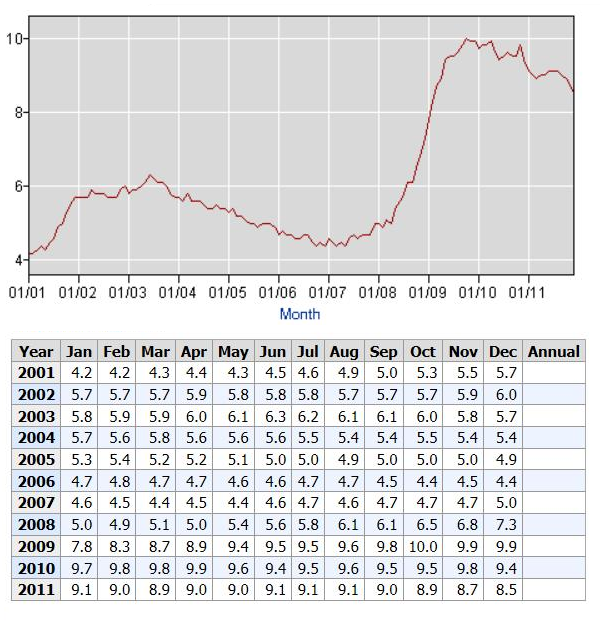

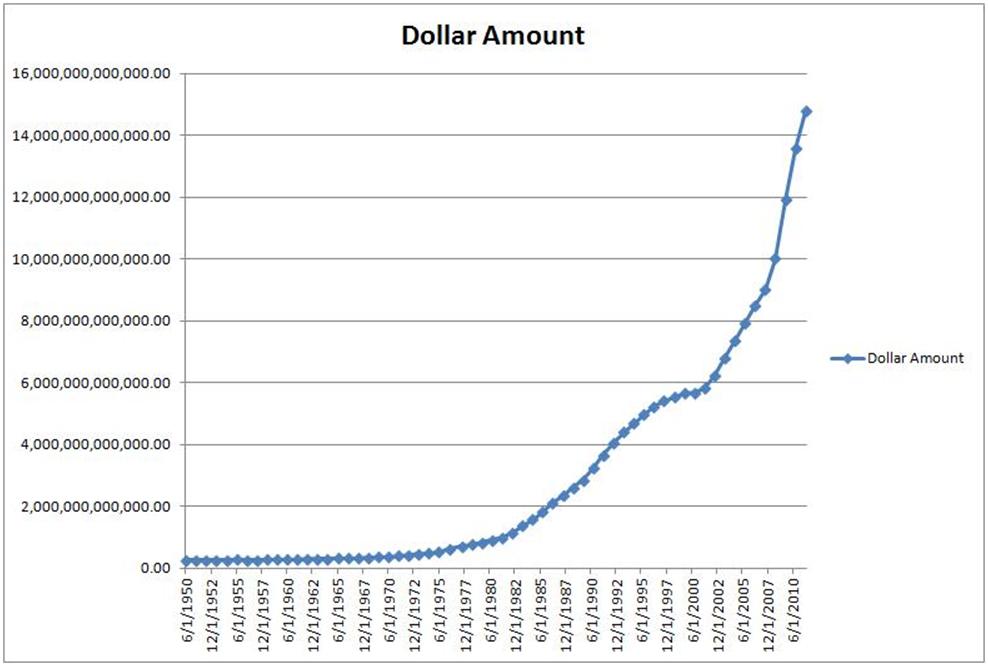

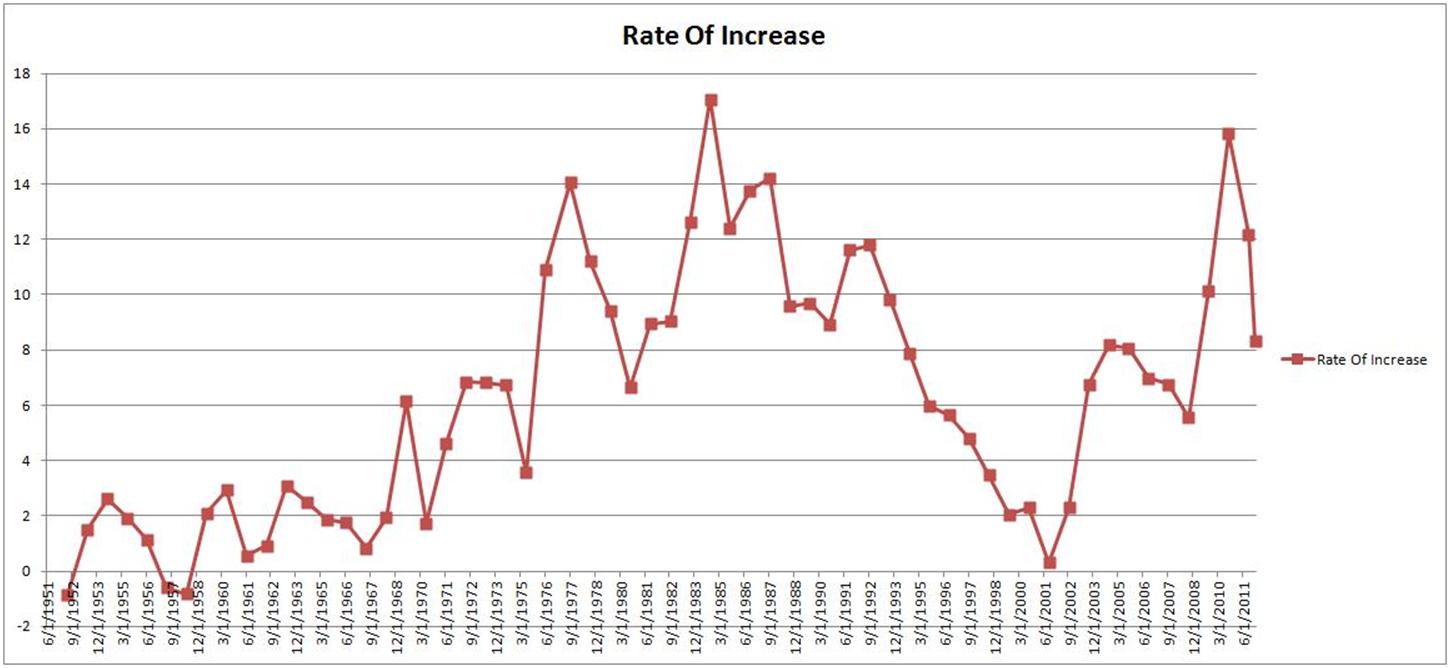

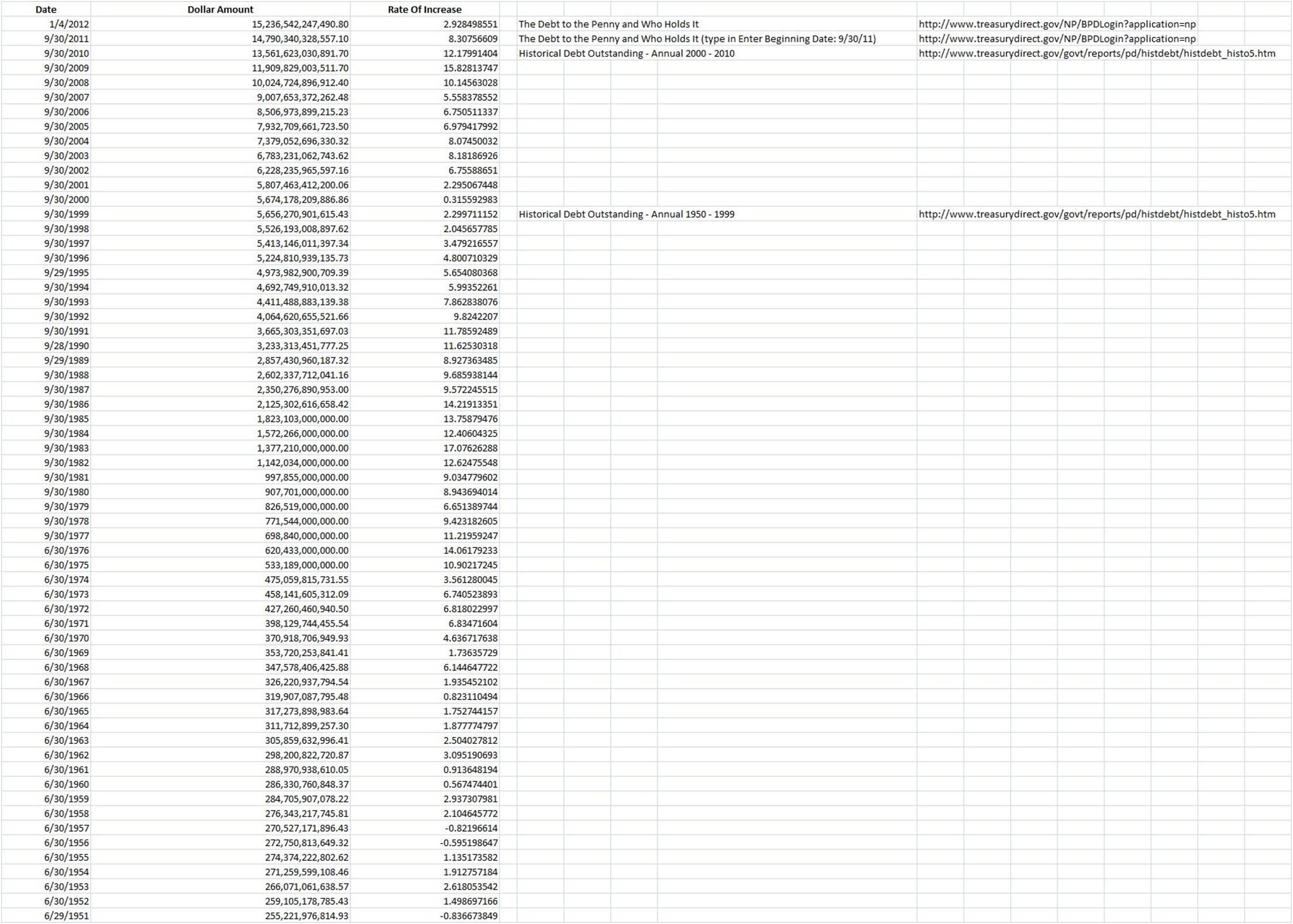

I really do think Obama has done a good job for the most part in light of what was happening when he came into office. I have written extensively on my blog using many statistics to show the progress that has been made in spite of all (including Republican naysayers) during the Obama administration including data from the Bureau of Labor Statistics, the Treasury Department, GAO, CBO and many universities, notable market, economic, polling research organizations so I would think you would have to take that on first. I also think many people tend to forget the extremely deep hole the Bush administration left us in. One case where I personally recognize the ‘we were wrong so therefore we must pretend like we were right’ syndrome is for the Iraq and Afghanistan wars. The folks that put us over there seem to me to be unable to belly up to the bar and admit it was a mistake to go over there in the first place (except Ron Paul who is totally right on this subject!). I understand why folks feel a need to do this – all those amazing kids that were killed or maimed for life AND the huge deficit hole those wars dug for us. I saw this in the Vietnam War personally with my two older brothers whose young lives were lost in the jungle never to return and I THOUGHT we learned our lesson but I guess we must forget quickly. I also recognize that some may legitimately have thought these wars were necessary and it was a good thing we started them in which case, an examination of the facts, the supposed reasons, the benefit, the real as well as imagined results had we not started those wars, etc. would have to be investigated to arrive at any hope of a conclusion. Even still, this type of effort would not result in a ‘I was right and you were wrong’ silliness but probably more of a weighted, approximation that these facts, assumptions, conclusion seem to be more correct than their antithesis. Actually, I find that this form of cognitive dissonance that cannot settle on black and white conclusions is better to have going forward than the fantasmic black and white resolve that makes folks feel better but really only leaves them believing an easy delusion.

And finally, the point of these studies, or at least the way they’ve been reported in some cases, seems to include the implicit suggestion that liberals and progressives are smarter, more logical, less emotional thinkers than are conservatives. But interestingly, the most intelligent among us tend to lean pretty strongly libertarian. See, e.g., the results of a survey of Triple Nine Society members (who are in the 99.9th percentile for intelligence).

I did not see the results in the Triple Nine Society that are ear marks of a scientific and therefore well reasoned conclusion (statistical variance, random, double blind, etc.). Additionally, what is deemed ‘intelligence’ would have to clearly and narrowly be stated and defended in advance of even trying to make a conclusion. There were a few libertarian, conservative and liberal politicians mentioned but this is hardly a study. As a side, I will tell you a little story. When I lived in Dallas I made some Mensa friends and started going to their meetings. I was thinking about taking the test when some of them started telling me that they would give me answers and even the test I would take. Of course, this is anecdotal and perhaps not typical of Mensa but it discouraged me from going further – for me, it really just seemed like a club after that…

Oh, also, I did not think of these studies as giving any indication of intelligence. I think that was a leap on your part. I think the whole topic of intelligence is a can of worms (emotional, IQ, analytic, logical, poetic/artistic, folksy wisdom, etc.). I personally do not feel like these studies had anything to say about the intelligence of liberals or conservatives merely how they typically, in our particular present situation, handle making sense of their environment. There certainly is no claim to greater or lesser intelligence in the studies themselves…

*I highly recommend this report by the Census Bureau. It give much more detail than the usual statistics that are cited.