The Simpson-Bowles proposal was a good start in the direction to fiscal responsibility. There are three main aspects to the plan: cut spending, increase revenue through tax reform and stimulate growth. I believe that we will have to do all three to keep the country from spiraling into economic disaster. One of the report’s major concerns is the rising cost of health care. The report even goes so far as to suggest that we move “toward some type of all-payer system”. What we really need to understand is that we already have a very inefficient all-payer system. Under the Emergency Medical Treatment & Labor Act (EMTALA) enacted in 1986 under Ronald Reagan, any Medicare participating hospital cannot deny emergency medical care. Because this law exists, mandatory health care already exists. More specifically, all U.S. citizens are on the hook to pay health care costs. As far as I know there were no interstate commerce issues brought up under the Reagan administration or Supreme Court challenges by Republican attorneys generals. Yet, those of us with health care are required to pay for those that do not have health care. Apparently, since the requirement stems from a ‘free market’ mandate required by law that is deemed exempt from the disdain of a ‘government mandate’.

In any case, the rising cost of health care is due to the mandatory health care law long before President Obama and the increase in longevity. Since we already have to pay, no matter what the Supreme Court’s decision on Thursday, we should try to find a way to reduce the ever increasing cost of health care consistent with the laws we have or change EMTALA. This is one example of the way we are all paying more by the mandatory requirement that comes with citizenship. There are many ways that we end up paying more for the unfunded plight of others including large corporation bail outs, lower property values due to mortgage defaults, obesity and unhealthy eating (including not eating broccoli). This argument, made by Justice Scalia, is a slippery slope argument. He is basically saying that if we start down the broccoli path, where do we draw the line? What this argument misses is the bottom line. If we knew that not eating broccoli would result in each one of us having to pay twice as much per capita for health care as any other country and we would pay $1,100 more in premiums per year because others were not eating their broccoli, then I think not eating broccoli would hit much closer to home. The fact is that we know that we all pay more for uninsured health care. Emergency room health care is very expensive. The slippery slope argument misses that fact that not all possible cases of an argument are equally important. Thus, the slippery slope argument loses a sense of proportion in its abstractions; it loses the forest for the trees.

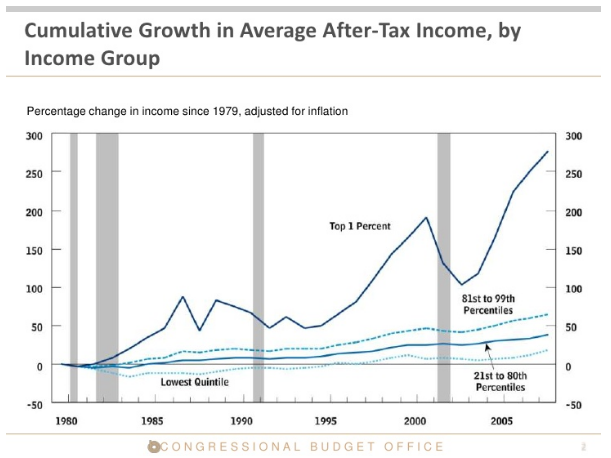

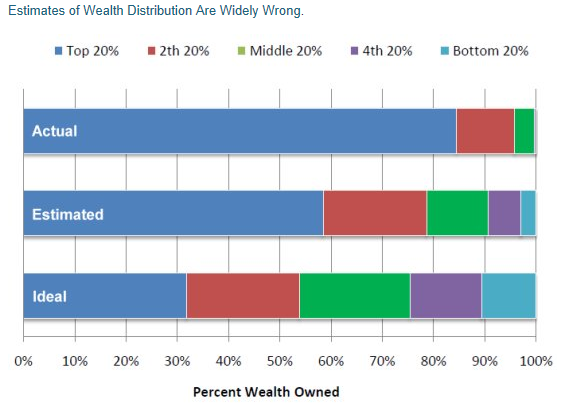

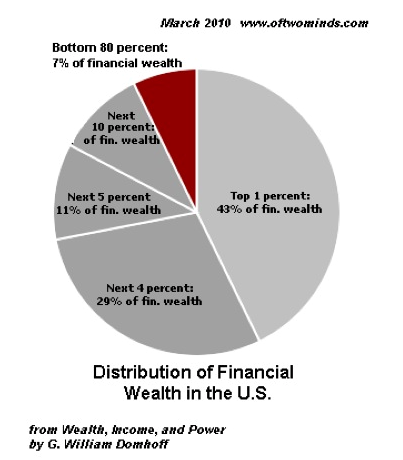

I like many of the ideas in the Simpson-Bowles proposal including tying the retirement age to longevity statistics. In any case, I take it as a given that we have no choice but to do all three recommendations of Simpson-Bowles. We will have to cut spending, increase revenues and stimulate growth. Simpson-Bowles advocates serious tax reform to achieve a net revenue increase. It also advocates lowering the corporate tax rate to bring companies back into the U.S. and spur growth. I would even go for lower corporate tax rates than Simpson-Bowles recommends. The bottom line is we will not be able to prevent economic catastrophe with spending cuts alone. We also need to understand that money out of pocket is money out of pocket no matter if it is from paying taxes or paying increased health care premiums for others lack of health care insurance. Simpson-Bowles does advocate the progressive tax system that we have in this country but some hard decisions need to be made. If we have less net revenue from reducing corporate taxes we will have to make up the difference and more from other means. Since you cannot squeeze blood out of turnip, taxing the poor is a non-starter. The middle class could absorb some tax hits if the net difference was less than what they are paying now after other costs are reduced (like higher health insurance premiums) but there is only so much there before we cut into the bone of the middle class. This leaves making up the difference with the wealthy. In this discussion I showed the huge increase in wealth CEO compensation over the last several decades. This trend has also been shown for the upper quintuple of income earners according to the U.S. Census Bureau.

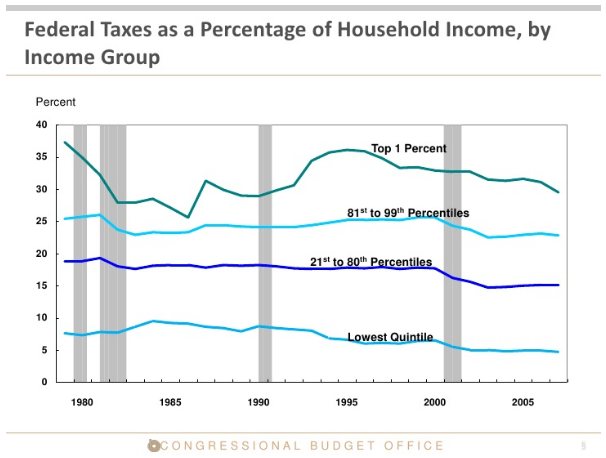

This, in spite of these changes in taxation:

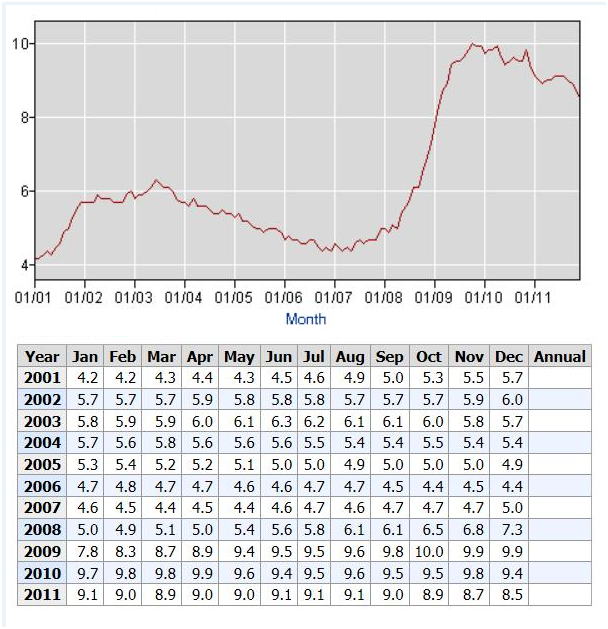

For most Americans that are not in the top 1% this would indicate that the last decade has been very good to the top 1%. According to the Republicans, these are the job creators. However, most Americans believe that the last decade was not very kind to them with regard to job creation. With all their current talk about President Obama being the job killer, a few important facts should finally put an end to this:

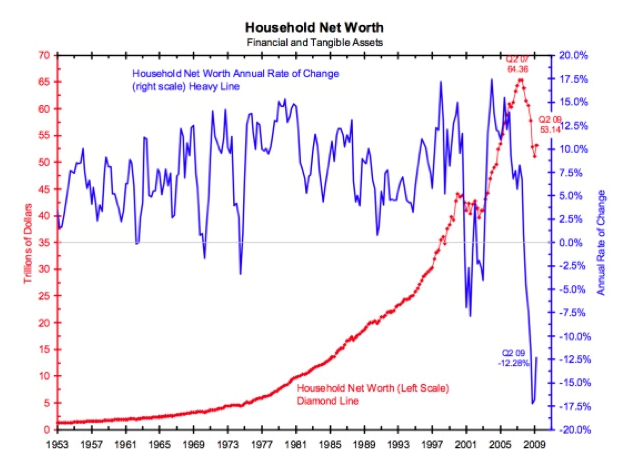

From this data by the Bureau of Labor Statistics, the absolute definitive source for unemployment statistics, it is obvious that unemployment peaked a few months into President Obama’s administration and has been coming down ever since. It is currently at 8.2%. The economy does not turn on a dime and the impact of the recession and the middle class decline became apparent as President Obama took office on January 20, 2009:

To blame this on President Obama has to go down as one of the greatest hoaxes of all time.

From these charts it is apparent that any real revenue increase will have to come from the wealthiest. With the needed reduction on corporate taxes it is also apparent that the top 1% will not cover the additional revenue gap.

My suggestion is that we need to calculate how far the tax increases need to go down the income bracket to make up corporate tax loses and actually increase revenues. I would suspect the levels would be no lower than singles making $250,000/year and couples making $500,000/year. However, all this should be done with the other net gains from tax reform and loophole reductions that Simpson-Bowles discussed. I think it is also inevitable that entitlements will take some hits and defense. If the growth predicted by Simpson-Bowles takes place some of these cuts could be reduced in the future. Personally, I have no problem increasing the marginal tax rates on the income levels just mentioned over and above those amounts increasingly to a very high percentage of income at the top; possibly as high as 80% over $10,000,000/year. Please note that this is not 80% of $10,000,000 but taxed at a rate of 80% over $10,000,000. I would favor executives be given a vested interest in their companies with more stock options that could be taken out over multiple years at capital gains rates. I also favor capital gains reductions based that are income adjusted down as low as zero for the bottom income brackets. However, I think that rates would need to be raised for higher capital gains income brackets.

The criticism Republicans make about such a notion is that the ‘job creators’ would take their marbles and go away. As these charts have shown, it is not apparent that increasing the job creator’s wealth has created jobs. They seem to indicate the contrary that jobs have been severely lost while their incomes were severely increasing. Additionally, increasing the stake a CEO has in a company by primarily rewarding them with stocks has seemed to work well in Japan. There is no need to think it would not work well in this country. From my perspective, there is way too much noise about giving a helping hand to the wealthy and way too little noise about helping the middle class which is responsible for the lion’s share of the 2/3 of the economy that consumers represent. If we can bail out companies too big to fail why can’t we bail out the folks that make up most of our economy?

One more point with regard to too big to fail. We have financial regulations that were greatly strengthened by the Dodd–Frank Wall Street Reform and Consumer Protection Act which prohibit financial institutions from using federally insured depository accounts for risky investments without reserve requirements. This regulation and its predecessors protect us, the tax payer, from having to bail out financial institutions that go under with our tax dollars. Bail outs cost us money just as health care consumers without insurance. I think too big to fail should also require regulations that require certain organizational structures in huge corporations that isolate and limit the damage if one part of the company goes under. We know how to do this with federal depository institutions. Just as regulation protect us from massive bank failures requiring taxpayer bailouts, companies that are too big to fail should be set up structurally by law so they limit the exposure of the taxpayer. I know there is some dispute among the free marketers that they should just be allowed to fail. I think that should be true in most cases. However, there obviously is some point where huge multinational corporations could hurt the rest of the economy if they went under and I would not want to test the limits of where that would be with ‘liberal’ limits and regulatory safeguards. When we saw Paulson and Bush, two adamant free market advocates, with fear in their faces tell us we had to take action to keep certain companies from going under, we all should have received a wakeup call. Pure free market advocates appear willing to take any chance that comes along. However, I think assuming the economy could absorb any size hit without significant ramifications is a bit like playing Russian roulette with our economy. I would think that the prudent and conservative thing to do would be to protect ourselves as much as possible before we test the limits.