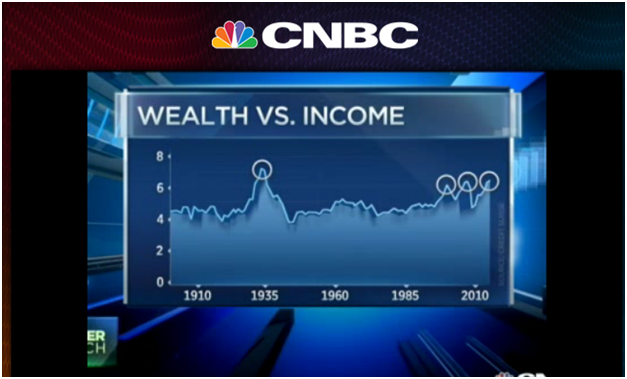

According to a report just release entitled, “Credit Suisse : The wealth gap is starting to worry the arch-capitalists“1, the wealth to income gap is the largest it has been since 1929. If 1929 rings a bell it is because it was the start of the Great Depression. Credit Suisse is by no means a left leaning group. They provide advisory services for private banking, wealth management and investment banking (ticker CSGN).

Every time we have had a spike in this benchmark we have had a severe depression or recession. The folks at Credit Suisse are arch-capitalists. In the report they state:

Curiously, the Marxist view that the unequal distribution of capitalism’s rewards creates a potentially catastrophic drag on the economy has lately become conventional wisdom among such deeply capitalist institutions as the IMF and ratings agency Standard & Poor’s.

They go on to state that the reason for this is that rich people do not buy enough. Also, credit has tightened a lot for average folks in the last decade. They further state:

The problem of depressed demand is unlikely to be resolved at all by the workings of the market, which left to its own logic will continue to concentrate most wealth in the hands of a tiny few.

The movement towards flat income and incredible gains by the wealthy is called plutocracy. Plutocracy leaves the legitimate realm of a capitalist meritocracy and not only brings us closer to another economic depression but, as history has abundantly demonstrated, will eventually make a violent revolution more likely. As I stated in my recent post “Modernity and the Contradiction of Values Dilemma“, the lack of viable checks and balances in laissez-faire capitalism, intelligent regulation, is a contradiction of the values of modernity. Elitism has always been the direct outcome of plutocracy as the Gilded Age readily shows. It seems that there are trends in post-modernity that are again tugging at the reins of elitism. Anyone that advocates the principles that lead us back to plutocracy and elitism also must silence the bodies of modernity which advocated democracy, the common folk, and was embodied in the U.S. Constitution.

In this election season, each voter should ask themselves which political party would bring us closer to de-regulation, lower taxes for the wealthy and large corporations, and cutting and eliminating social programs that put money into the hands of the poor which get spent much more readily that in the hands of the wealthy. The Republicans have been slashing government funding and housing programs (NGOs) which benefit the poor and middle class. Now, they even have the nerve to bash the Democrats for the lack of affordable housing and blame the government for ignorantly turning Ebola away in the emergency rooms of their De facto health care plan2.

Please ask yourself which party is more likely to support checks and balances in the market, find ways to get cash into the hands of those that will spend it, solve long term health care issues or at least make an attempt. It is also commonly known even among the most conservative economists that our economy has always done better under Democratic administrations than Republican administrations3. Also, when you think of political attempts at solutions versus road blocks and naysayers what political parties come to mind?

Look at where Austrian styled economics got us with radical financial de-regulation. Credit default swaps fueled the fires of a private mortgage wildfire. NGO’s loan failures were very small compared to private mortgage company failures. The bi-partisan FCIC report on the Housing Crisis of 2008 concludes:

The Commission also probed the performance of the loans purchased or guaranteed by Fannie and Freddie. While they generated substantial losses, delinquency rates for GSE loans were substantially lower than loans securitized by other financial firms. For example, data compiled by the Commission for a subset of borrowers with similar credit scores—scores below 660—show that by the end of 2008, GSE mortgages were far less likely to be seriously delinquent than were non-GSE securitized mortgages: 6.2% versus 28.3%.4

President Bush admitted the ‘mistake’ which put ‘boots on the ground” in Iraq and cost taxpayers trillions of dollars in foreign wars. Yet, the current political narrative has lost the perspective of the cost of those wars, in lives and capital, relative to the much lower cost of foreign involvements during the Obama administration.

Austrians take government austerity to an extreme. The difference between the U.S. recovery and European economic stagnation are commonly known to be the intervention of the Federal Reserve here and the tightening of fiscal policy by the German central bank. The Austrians would eliminate the Federal Reserve. They think the Federal Reserve “prints money”. The fact is the Fed sells government bonds through the Treasury department just as a private corporation sells bonds to raise money. “Printing money” would mean we would simply make the currency with no intention of paying it back. This type of narrative hides the basic function of a Treasury bond to manipulate the naive.

In keeping with their ‘selective’ austerity ideal, Republicans in Congress continually target government programs they oppose. They were not in favor of cutting the Medicare Advantage program they started which was a boondoggle for private insurance companies but cost the taxpayer 12% more for the same programs under traditional Medicare5 They would not cut the bloated defense budget without having too under budget sequestration in 2013. They refused to let the prescription drug plan, started under Bush 43, negotiate cost with insurance companies for bulk purchases as any private company would do. This has and will continue to cost the taxpayer billions of dollars. Due to this, the prescription drug program will cost as much as ObamaCare did over 10 years. No Republican has ever tried to repeal the prescription drug plan or change the law to save the taxpayer billions while providing the same services.

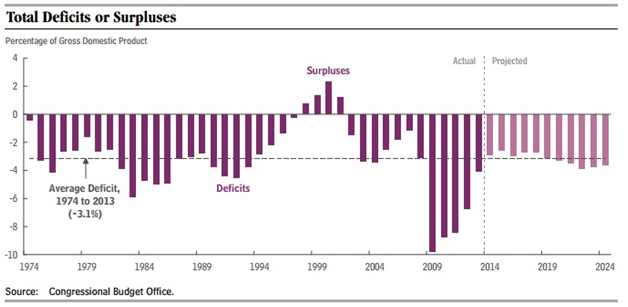

Republicans only favor cutting government programs they deem as wasteful such as education, environmental, food stamps which helps farmers as much as it helps the hungry. Republican cutting has hit many government department budgets including the CDC, embassy security, blocking infrastructure bills, cutting taxes on the wealthy while making sure that the poor masses would find it much harder to vote. In spite of their pet programs, under President Obama, the deficit has come down dramatically.

6

6

The spike at the beginning of the Obama administration had nothing to do with ObamaCare which had not even hit the budget in those years. The spike was a result of the great recession started by the Bush administration which controlled both Houses of the Congress for six years and had a conservative majority in the Supreme Court. It reflects decades of congressional mandated spending under both parties and had absolutely nothing to do with anything the Obama Administration did. You would never know that by listening to popular rhetoric. The economic recovery since then and reduced deficit spending should have been a high credit to the Obama administration but the narrative has been turned upside down by big money political marketing in large part thanks to the Citizens United decision.7

Did we gain oil independence in the Bush administration? The International Energy Agency (EIA) predicts we will by 2015.8 If you listen to Republican rhetoric funded by the oil industry you would think that the EPA and President Obama has cripple energy oil production. The opposite is actually true.

Forbes recently published an article entitled “Obama Outperforms Reagan On Jobs, Growth And Investing”.9 The data shows that while Reagan was considered the best economic president in recent history he lags Obama in “all commonly watched categories”:

Economically, President Obama’s administration has outperformed President Reagan’s in all commonly watched categories. Simultaneously the current administration has reduced the deficit, which skyrocketed under Reagan. Additionally, Obama has reduced federal employment, which grew under Reagan (especially when including military personnel,) and truly delivered a “smaller government.” Additionally, the current administration has kept inflation low, even during extreme international upheaval, failure of foreign economies (Greece) and a dramatic slowdown in the European economy.

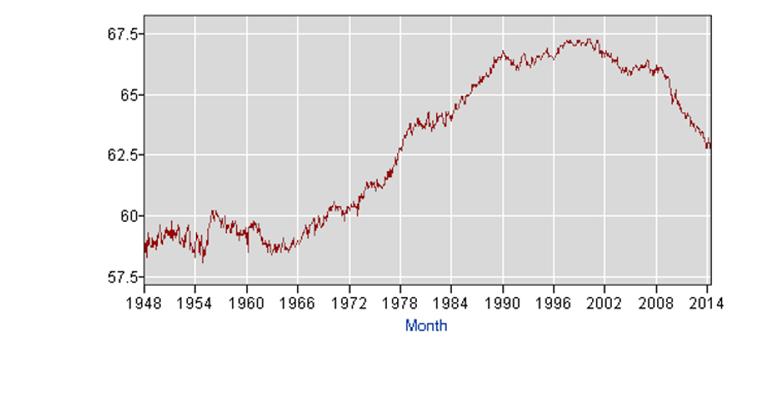

While job participation, what the Republicans call “real unemployment”, has remained relatively flat since 1994, there was a rise in job participation during the baby boom years under Reagan and a decrease under Obama as baby boomers retire. This chart shows the difference between reported unemployment and all unemployment, including those no longer looking (called U6, it has been tracked since 1900). It has “remained pretty constant since 1994”.

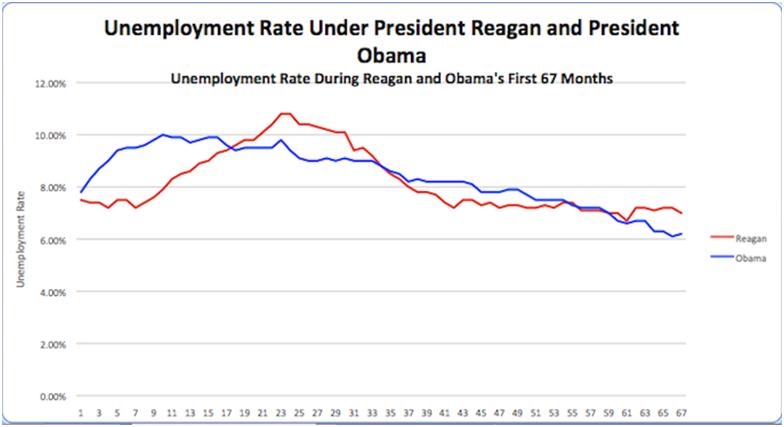

Here is a comparison of unemployment under President Obama and Reagan:

It shows unemployment did not peak as high as it did for Reagan and recovered faster under Obama. Is this the message most folks are hearing? The current perceptions of President Obama are produced by those who could care less about the real facts.

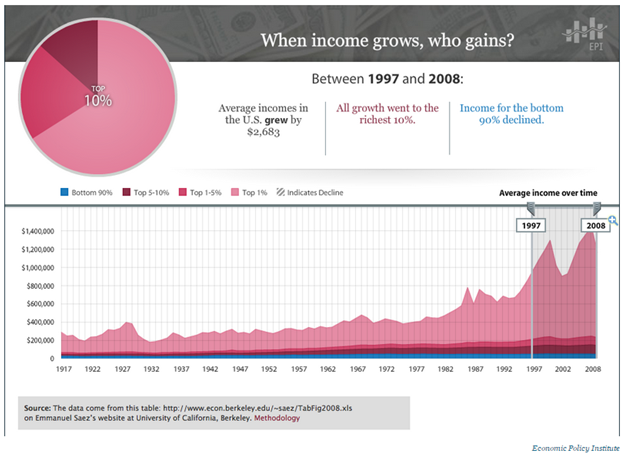

When Republicans defend the wealth factor they often tell us that wealthy people create jobs. While only a small percentage of wealthy people actually finance start ups directly, their defenders suggest that stock investments indirectly finance companies that do create jobs. So who gains when jobs are created:

10

10

While rich folks may create some jobs they pale in job creation when it comes to a healthy middle class. It is really simple: the rich may create a job but the economy’s job creation engine is from the consumer who spends and thus creates multiple jobs. The rich will thrive whether the economy is good or not as the graph above shows. The referenced “Business Insider” article from the graph above goes on to state:

Now, again, entrepreneurs are an important part of the company-creation process. And so are investors, who risk capital in the hope of earning returns. But, ultimately, whether a new company continues growing and creates self-sustaining jobs is a function of the company’s customers’ ability and willingness to pay for the company’s products, not the entrepreneur or the investor capital. Suggesting that “rich entrepreneurs and investors” create the jobs, therefore, Hanauer observes, is like suggesting that squirrels create evolution.

Even more so, the great Reagan litmus test of “are you better off now than you were” at the end of the Republican’s great recession of 2008 has been completely ignored. Do we really want to go back there? Are the Republicans the ones that are going rally behind the middle class and their incomes? In spite of the doomsday sayers about Obama, where is the hard evidence that his administration will end worse than the previous Republican administration did? Are folks so gullible that they cannot remember recent history over the continual, highly financed squeals of rhetorical propaganda? I sincerely hope not. In any case, all I can say is that If the Republicans get back into office in 2014, we will all get what we deserve.

“Those who cannot remember the past are condemned to repeat it.” George Santayana

_________________

1 Here is a video about this shown on CNBC today.

3 See The Great Lie: The Great Depression and Recessions of the United States

4 See THE FINANCIAL CRISIS INQUIRY REPORT, page xxvi

5 See Extra Payments to Medicare Advantage Plans Totaled $5.2 Billion Over Fee-For-Service Costs in 2005, Also The Ryan Plan: Part 1

6 See CBO An Update to the Budget and Economic Outlook: 2014 to 2024, page 8.

7 See Formalism: When a Lie Becomes Truth (really)

8 See IEA Predicts the U.S. Will Be the World’s Largest Oil Producer by 2015

9 See Obama Outperforms Reagan On Jobs, Growth And Investing

10 See Sorry, Folks, Rich People Actually Don’t ‘Create The Jobs’ in Business Insider.

Interesting comments. Wealth is a result of saving and investing. Several factors impact the savings rate — one is flat income but another is social pressure to “keep up with the Joneses”. People need to be able to delay gratification on non necessities to accumulate savings and eventually build wealth. Perhaps the idea of necessity needs revisiting — expensive cells phones and tech gadgets, expensive cars, eating out frequently, etc may not be “necessities”.